Managing business expenses can be a daunting task for business owners in Leominster, MA. Ensuring financial efficiency, while allocating resources to fuel growth, requires insight and expertise. By partnering with a professional Certified Public Accountant (CPA) like Henry Kulik, business owners can develop expense management strategies that pave the way for success and growth.

Effective expense management begins by understanding the different types of business expenses, including fixed costs like rent and salaries, and variable costs such as utilities and supplies. By gaining a comprehensive understanding of these costs, businesses can develop tailored strategies that optimize resources and keep expenses in check, ultimately impacting their bottom line.

The importance of expense management cannot be overstated, as it directly affects a company’s financial performance, competitiveness, and growth potential. By closely monitoring and controlling expenditures, companies can maintain a healthy cash flow, minimize waste, and instill efficiency in their operations.

However, achieving this level of financial efficiency requires a focused approach targeting key areas, including cost reduction measures, strategic resource allocation, and continuous process improvement. In this regard, having the guidance and expertise of a professional CPA proves to be invaluable. A CPA’s financial analysis, strategic planning, and deep understanding of tax regulations and industry-specific nuances can significantly enhance a company’s expense management efforts.

Additionally, with the advancement of technology, businesses can leverage powerful accounting software and tools that help streamline and automate expense tracking and management tasks, further improving their expense management strategies.

In the following sections, we will delve into the various aspects of effective business expense management and how a strategic partnership with a professional CPA like Henry Kulik can transform your approach to financial efficiency and business growth.

Understanding Business Expenses: Laying the Groundwork for Efficiency

An essential step toward effective expense management is gaining a clear understanding of your business expenses. Both fixed and variable costs contribute to your company’s overall financial performance, and recognizing these expenses allows you to develop optimized strategies for monetary efficiency.

Fixed costs, such as rent, salaries, and certain insurances, are constant and independent of your business’s volume of transactions. Variable costs, on the other hand, fluctuate with changes in production or sales and may include utilities, materials, and freight costs. By comprehending which expenses fall into each category, you can tailor your management approach accordingly and identify areas of potential savings.

Importance of Effectual Expense Management: Boosting Competitiveness and Growth

Expense management holds the key to a company’s financial health, directly influencing competitiveness, cash flow, and growth potential. When businesses efficiently monitor and manage their expenditures, they can maintain a healthy financial standing, minimize wasteful spending, and make data-driven decisions to improve resource allocation.

Effective expense management ensures that every dollar spent contributes to the growth and success of the company. By adhering to sound expense management practices, businesses can enhance operational efficiency, maintain a competitive edge, and position themselves for long-term growth.

Areas of Focus for Strategic Expense Management: Optimizing and Innovating

To unlock the full potential of effective expense management, it is crucial to concentrate on key areas where optimization can yield significant results. Some vital areas of focus include:

1. Cost Reduction: Analyze your expenditures to identify opportunities for cost-cutting that won’t compromise your business’s quality or performance. Common cost reduction strategies encompass renegotiating contracts, exploring tax credits and incentives, and reducing waste.

2. Resource Allocation: Evaluate how you allocate resources to various projects or departments within your company. Ensure that every investment you make adds value to your business and aligns with long-term strategic goals.

3. Process Improvement: Consistently review your business processes to identify inefficiencies and opportunities for improvement. Implementing lean methodologies, streamlining procedures, and automating mundane tasks can significantly enhance efficiency and reduce costs.

How a CPA’s Expertise Enhances Expense Management: Unlocking Financial Mastery

While approaching expense management from a strategic standpoint is crucial, the guidance of a professional CPA can elevate your efforts by providing tailored insights and invaluable expertise.

A professional CPA like Henry Kulik can deliver critical value to your expense management endeavors in several ways:

1. Financial Analysis: A CPA’s thorough financial analysis can expose hidden inefficiencies and unearth areas of potential cost savings. By identifying trends and patterns in your expenses, a CPA can craft targeted strategies for financial optimization.

2. Strategic Planning: Partnering with a professional CPA enables you to take a more proactive and strategic approach to expense management. By setting financial goals and developing achievable plans to reach them, you can position your company for sustainable growth.

3. Regulatory Compliance: A CPA’s in-depth understanding of tax laws and regulations ensures that your expense management approach remains compliant while maximizing tax benefits and credits.

Leveraging Technology for Efficient Expense Management: Streamlining Operations

Modern accounting software and tools empower businesses to manage expenses more effectively, simplifying the tracking and analysis of expenditures. By investing in technology, companies can automate repetitive tasks, reduce the potential for errors, and access real-time financial data to make better, more informed decisions.

A professional CPA can help you identify and implement the accounting tools that best align with your business needs, ensuring seamless integration and enhanced functioning within your operations.

Some benefits of leveraging technology for expense management include:

1. Simplified Data Entry: Contemporary accounting software enables easy and accurate recording of expenses, eliminating the need for manual data entry and reducing the likelihood of errors.

2. Real-time Financial Data: Immediate access to up-to-date financial information allows you to monitor expenses closely and make timely decisions to stay on budget.

3. Advanced Analytics: Sophisticated analytical capabilities empower you to interpret your financial data in meaningful ways, making it easier to identify trends and opportunities for improvement.

Conclusion

As the adage goes, “a penny saved is a penny earned.” Effectual business expense management is key to unlocking your company’s full financial potential and driving growth. By partnering with a professional CPA like Henry Kulik, Leominster businesses can sharpen their focus on strategic expense management and reap the rewards of operational efficiency and competitiveness.

Understanding your expenses, concentrating on key areas of optimization, and leveraging both CPA expertise and professional accounting services will transform your approach to managing expenditures. Don’t miss out on the advantages that professional expense management guidance can bring to your business.

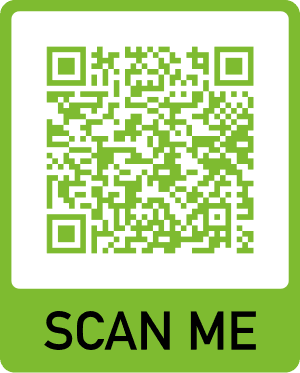

Schedule a consultation with Wasilidas & Kulik CPA PC and discover how tailored strategies can maximize your business’s financial efficiency and growth potential today.